The introduction of Single Touch Payroll (STP)

February 19, 2026

Author name

We have had a number of inquiries from our clients seeking to understand the upcoming introduction of Single Touch Payroll (STP). Although payroll is not our Bailiwick and this issue is not directly relevant to us, we are happy to give our clients some general understanding to assist them to meet their legal obligations. This article does not provide legal or accounting advice but is for the purpose of improving understanding by simplifying the information available from the ATO – https://www.ato.gov.au/Business/Single-Touch-Payroll/

STP is a new way of reporting tax and super information to the ATO. It is important to be aware that STP does not in any way change your existing practices, obligations or rates of pay.

STP will be a legal obligation on small employers from 1 July 2019. This is a perfect time to review all of your legal obligations to ensure you are complying with all employment regulations and protecting yourself against disputes or claims from your employees.

Things you need to check

- As an Employer do you know your legal obligations for documents and records?

- Is your casual employee really a casual employee?

How STP works

STP works by sending tax and super information directly from your payroll or accounting software to the ATO every time you run your payroll.

When you start reporting:

- you will run your payroll, pay your employees as normal, and give them a payslip – your pay cycle or method does not need to change.

- your STP-enabled payroll software will send a report to the ATO which includes the information they need from you, such as salaries and wages, pay as you go (PAYG) withholding and super information.

At the end of the financial year, you’ll will need to finalise your STP data. This is a declaration to the Commissioner to state you have completed your reporting for the financial year. You will no longer have to give your employees a payment summary (group certificate) or provide the ATO with a payment summary annual report.

You can report STP through one of the following ways:

- Report from your current payroll solution when it is STP-ready. A payroll solution is the accounting, business management or payroll software you use to run your payroll and pay your employees.

- Report from a new payroll solution which is STP-ready.

- Ask a third party, such as your registered tax agent, to report to STP on your behalf.

In essence, nothing will change in how you process payroll.

The main thing is that after each “payroll” you will have to send some additional reporting information to the ATO. The obligation is on you as the employer to send information to the ATO.

No-cost and low-cost solutions for Single Touch Payroll

Employers with 1-4 employees (micro employers)

If you have four or less employees (micro employer) and you don’t currently use payroll software, there will be other ways to report STP information.

The ATO asked software developers to build no-cost and low-cost STP solutions for micro employers – including simple payroll software, mobile phone apps and portals.

They have published a list of the companies intending to offer these solutions. Find out more at https://www.ato.gov.au/business/single-touch-payroll/in-detail/low-cost-single-touch-payroll-solutions/

If it’s all too hard …

You will also have the option for your accountant, registered tax or BAS agent to report your STP information quarterly, rather than each time you run payroll. This option will be available until 30 June 2021.

If you would like assistance generally in employment matters, please contact us on (08) 9321 5451 or by email phil@bailiwicklegal.com.au.

For further information about our legal services, please visit our website: https://www.bailiwicklegal.com.au/

The above information is a summary and overview of the matters discussed. This publication does not constitute legal advice and you should seek legal or other professional advice before acting or relying on any of the content.

Bailiwick Legal has been honoured to support Forever Wild over the past few years as they delivered one of the most significant conservation land acquisition programs undertaken in Western Australia. Our team assisted Forever Wild with the strategic purchase of four pastoral stations, Narndee , Boodanoo , Meeline and Challa , transactions that now connect three State Reserves and protect more than 12,000 square kilometres of land. To put that scale into perspective, the combined area is approximately five times the size of the ACT and nearly one-fifth the size of Tasmania . Navigating complexity at scale These were not straightforward property transactions. Each acquisition involved: Multiple pastoral leases Layered regulatory and approval pathways Significant operational and on-ground assets Numerous stakeholders across government, industry and land management Our role was to guide Forever Wild through this complexity with clarity, precision and confidence, ensuring each transaction progressed efficiently while managing risk and safeguarding long-term objectives. “ Forever Wild is creating a world-leading model for nature funding that demonstrates we can manage viable, working pastoral stations whilst also restoring and protecting local ecological flora and fauna, and engaging and supporting Indigenous people and local communities. Complex & challenging, but this initiative could literally change the world .” Jessica Brunner - Director, Bailiwick Legal A growing and evolving legal landscape Large-scale conservation acquisitions sit within an emerging and increasingly complex legal field , intersecting land tenure, pastoral regulation, environmental frameworks and commercial considerations. These matters demand a deep understanding of both the legal mechanics and the practical realities of operating in regional and remote Australia. Our team’s experience in agribusiness, pastoral land transactions and regulatory approvals allowed us to support Forever Wild at every stage, from strategic structuring through to completion. Proud to support leadership in nature finance Forever Wild is widely recognised as an industry leader and a steadfast advocate for nature finance initiatives , helping pave the way for greater accessibility and innovation in conservation funding and land stewardship. We are proud to have contributed our relationships, expertise and practical legal insight to help Forever Wild achieve its vision, and to have played a role, however small, in shaping a groundbreaking future for conservation in Australia. At Bailiwick Legal, we value the opportunity to work alongside organisations that are thinking long-term, acting boldly, and creating outcomes that extend well beyond the transaction itself. For assistance with all of your agribusiness needs, contact Bailiwick Legal on 08 9321 5451 or email office@bailiwicklegal.com.au For further information about our legal services, please visit our website: https://www.bailiwicklegal.com.au The above information is a summary and overview of the matters discussed. This publication does not constitute legal advice and you should seek legal or other professional advice before acting or relying on any of the content.

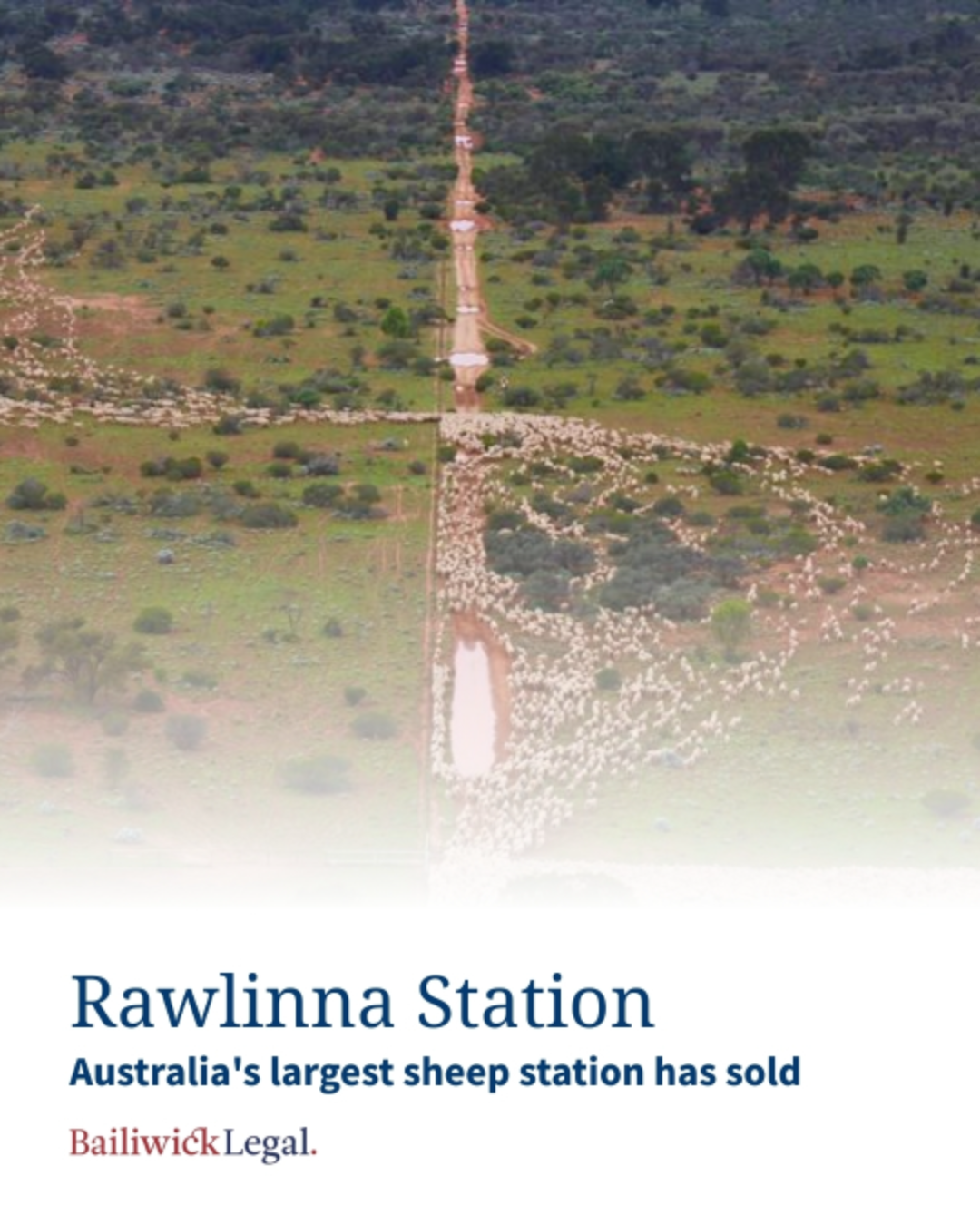

Bailiwick Legal Advises on Landmark Acquisition of Rawlinna Station by Consolidated Pastoral Company

Bailiwick Legal is proud to have acted for Consolidated Pastoral Company (CPC) in its successful acquisition of Rawlinna Station , Australia’s largest sheep station, located on the remote Nullarbor Plain in Western Australia. Spanning over 1 million hectares and running approximately 30,000 sheep , Rawlinna is an iconic pastoral asset with a rich legacy, having been held by the MacLachlan family’s Jumbuck Pastoral Company since its establishment in 1962. The sale marks the first change of ownership in over six decades and was finalised following formal approval from the Western Australian Government for the transfer of the pastoral leases. This transaction involved navigating: The transfer of three separate pastoral leases Coordination across multiple vendor entities Consideration of livestock and operating assets Fulfilment of regulatory and compliance requirements, including WA lease approval processes Bailiwick Legal is a boutique agricultural and regional law firm , proudly based in Perth and Bridgetown, Western Australia. Our role in this acquisition demonstrates that deep sector knowledge, local insight, and personalised legal support are crucial for agribusiness clients managing complex, high-value transactions. Our team, led by our regionally-based solicitor, Matilda Lloyd, provided end-to-end legal and strategic support, including: Due diligence on land tenure and operating assets Contract negotiation and preparation Advice on regulatory approvals and compliance Strategic coordination with CPC’s internal and external stakeholders to ensure a smooth and timely settlement We are honoured to have supported CPC in this milestone acquisition and look forward to watching Rawlinna’s next chapter unfolds. At Bailiwick Legal, we believe that regional expertise, deep industry knowledge, and relationship-based service remain essential to agribusiness success, no matter the scale. Congratulations to all parties involved, including the MacLachlan family, whose stewardship of Rawlinna leaves a lasting legacy in Australian agriculture. – The Bailiwick Legal Team Working alongside agribusinesses to grow, transition, and thrive . For assistance with all of your agribusiness needs, contact Bailiwick Legal on 08 9321 5451 or email office@bailiwicklegal.com.au By Matilda Lloyd (Associate) For further information about our legal services, please visit our website: https://www.bailiwicklegal.com.au The above information is a summary and overview of the matters discussed. This publication does not constitute legal advice and you should seek legal or other professional advice before acting or relying on any of the content.